or

descending into Tourette'sUp, Down.

"home is where they have to take you in when you have to go there," we used to say at our house when I was a boy, I must have learned that it was a misquote of Robert Frost somewhere along the line, maybe not ... I do remember bragging about it many times over the years

"Home is the place where, when you have to go there,

They have to take you in."

The Death of the Hired Man, 1915.

watching Bertolucci movies yesterday, stolen downloads, and I noticed the repetition of "there is no love, there are only proofs of love," so I tried to check it out, got as far as Pierre Reverdy and what looks like more of it, in english at least, “There is no love; there are only proofs of love. Whatever love I might feel in my heart, others will see only my action,” but I could not find a way back to the original whatever it was, not via the Internet anyway ... Reverdy was not famous enough I guess, not as famous as Robert Frost maybe, only this, "Il n'y a pas d'amour, il n'y a que des preuves d'amour," who knows where it came from?

watching Bertolucci movies yesterday, stolen downloads, and I noticed the repetition of "there is no love, there are only proofs of love," so I tried to check it out, got as far as Pierre Reverdy and what looks like more of it, in english at least, “There is no love; there are only proofs of love. Whatever love I might feel in my heart, others will see only my action,” but I could not find a way back to the original whatever it was, not via the Internet anyway ... Reverdy was not famous enough I guess, not as famous as Robert Frost maybe, only this, "Il n'y a pas d'amour, il n'y a que des preuves d'amour," who knows where it came from?

the bit of Frost must have entered the fanily pantheon through my father, maybe my grandfather, and of course it was complete fiction, uma ficção, like the partly literary confusion in my mind conflating the death of Poe and the death of my grandfather rolling drunk & disappointed from a ferry into some river (the Potomac? the Anacostia?), which it is too late to sort out now - ah! must have been dad because grandfather was dead before 1915 when the poem came out, or who knows? Frost might have been imitating some American proverb ... whatever ... home has proven to be anything but ... and the joke's on me

I am reading Joseph Tainter's The Collapse of Complex Societies, published in 1990, so written in say, 1985-1989? which seems to me important because a central point point, that complex societies are hardly incapable of addressing threats of the nature of climate change, doesn't wash with the denial that I see going on everywhere around me ... it may simply be that at the time he was writing the subtleties of tipping points had not yet penetrated the social imaginary, I wonder? toppling dominoes running off into the distant future?

I am reading Joseph Tainter's The Collapse of Complex Societies, published in 1990, so written in say, 1985-1989? which seems to me important because a central point point, that complex societies are hardly incapable of addressing threats of the nature of climate change, doesn't wash with the denial that I see going on everywhere around me ... it may simply be that at the time he was writing the subtleties of tipping points had not yet penetrated the social imaginary, I wonder? toppling dominoes running off into the distant future?

and there is his curious inclusion of the story of the Ik people of north-east Uganda, there is a strong rhythm to the structure he uses in this book which this story does not fit, I am waiting for Colin Turnbull's controversial The Mountain People and also a biography ... Tainter seems to have taken Turnbull's story at face value, why? because it is a homily on individualism and greed? a Wall Street parable? ... but hey! wtf do I know that I didn't just find in Wikipedia? right?

nonetheless, I also wonder if what I see as the coming collapse, even discounting psychological projections of flaccid old age and microcosm/macrocosm folderol, is not unique by virtue of the rise of global politics? and thus beyond Tainter's radar?

and I wonder about Tainter himself, a powerful categorical thinker but possibly stuck in a blind spot? governed or occluded by career? status? inertia? politics?

Joseph Tainter, Ik, Colin Turnbull.

maybe it will come clearer later on ...

I did find a later essay by Tainter, from 2005, in which the issue of long term problems seems to be dealt with - and yet I see no consideration of nor remedy for the possibility that by the time we wake up to climate change we may have already crossed the lines governing future tipping points, which leaves only mitigation and adaptation for my grandchildren ... taking my mind into the realm of science fiction & transcendent evangelical bliss ... God knows, They'll Fly Away :-)

the simple fact that they are obviously singing together would seem to put the lie to Turnbull's notion ... but I haven't read him yet ... and the pictures could be post-proselytizer

sometime around 1955 there was a boy crossing Davisville Park from the streetcar stop towards home, in the night after choir practice, singing You Are My Sunshine at the top of his lungs, probably thinking of Doris Day's version with accorion and what not, here's another one by Johnny Cash & Bob Dylan, but really this post all started a few days ago with a Brazilian article about honeybees being possibly addicted by caffeine and nicotine, the story looks like it began in Israel, moved to The Daily Mail, and from there to Brazil, which got me thinking of Jimmie Rodgers singing Honeycomb, discovering along the way that there are two singers named Jimmie Rodgers, one born in 1897 and the other born in 1933

sometime around 1955 there was a boy crossing Davisville Park from the streetcar stop towards home, in the night after choir practice, singing You Are My Sunshine at the top of his lungs, probably thinking of Doris Day's version with accorion and what not, here's another one by Johnny Cash & Bob Dylan, but really this post all started a few days ago with a Brazilian article about honeybees being possibly addicted by caffeine and nicotine, the story looks like it began in Israel, moved to The Daily Mail, and from there to Brazil, which got me thinking of Jimmie Rodgers singing Honeycomb, discovering along the way that there are two singers named Jimmie Rodgers, one born in 1897 and the other born in 1933

a-and finally, a small window into Canadian home life, and also into the mind of an old man, James Bruce of Tampa Florida ... I met a bank robber one time, another old man, when he knew he was dying he lay down on his bed on his back with a bunch of cash and a shotgun on his chest under his crossed hands and just died, or so his son told me, we rang the church bell 83 times - once for each of his years

a-and finally, a small window into Canadian home life, and also into the mind of an old man, James Bruce of Tampa Florida ... I met a bank robber one time, another old man, when he knew he was dying he lay down on his bed on his back with a bunch of cash and a shotgun on his chest under his crossed hands and just died, or so his son told me, we rang the church bell 83 times - once for each of his years

if there were a home I would go there, my life becomes more and more audible, the facts catching up with an old schlemihl, I have to be a little careful that the neighbours don't overhear ...

if there were a home I would go there, my life becomes more and more audible, the facts catching up with an old schlemihl, I have to be a little careful that the neighbours don't overhear ...

FUCKING BITCH!

FUCKING SHIT!

USELESS BASTARD!

CUNT!

and a pumpkin grin for Michael K :-)

Appendices:1-1. Bees get buzz around caffeine, nicotine, Mark Rebacz, Feb 11 2010.

1-2. Why bees are partial to coffee and cigarettes - they may be addicted, Feb 11 2010.

1-3. Abelhas podem ser viciadas em 'café e cigarros', 13 fev 2010.

2. My pregnant stepdaughter wants to move in, Lynn Coady, Feb 12 2010.

3. Friends describe elderly suspect's desperation, Feb 13 2010.

4. Journal of Ecological Complexity: Social complexity and sustainability, Joseph Tainter, 4 May 2005.

***************************************************************************

My pregnant stepdaughter wants to move in, Lynn Coady, Feb 12 2010.

My friends and family say don't do it, but it's a done deal. What should I do?A reader writes:My husband's 21-year-old daughter is returning from another country, pregnant, with a man she has no plans to marry. Neither has any prospects here, and my husband has offered them our finished basement while she has the baby. I reluctantly agreed. My husband once said that if he had to choose between us he would choose his daughter. She and I never really got along; I found her lazy and disorganized. I feel this will mess up my retirement plans and possibly my marriage. I want to embrace the situation, but I feel resentful. My friends and family say don't do it, but it's a done deal. What should I do?

Negotiate boundaries - Jean Sharp, Ottawa:You say she is “lazy and disorganized” – that’s not the biggest thing in the world. Is this woman nice? Interesting? Kind? Loved by her father? In need of some support at the moment - yikes! In order to not throw the baby out with the bathwater, negotiate some agreeable boundaries and timelines that you can live with. For all you know, they have no intention of living with you well into your dotage. Who knows, you may be inhabiting their basement some day.

Undo the deal - Penelope Hill, Dundas:They have started their own family – they should do it under their own roof. Offer to support them with a fixed monthly amount for, say, six months, whilst they find their feet. They will never learn responsibility as long as Daddy bails them out. Your own marriage sounds rocky. If it is headed for a breakup, better find out sooner than later. This is a deal breaker for your own marriage and I think you must know it.

Open your heart - Eric Mendelsohn, Toronto:You have two choices. The first: Be firm, reject this unwarranted intrusion on your retirement and face, like the strong and principled person you are, a lonely retirement (cue Basil Rathbone reading Charles Dickens) and dying alone and unmourned (cue Eleanor Rigby). The second: Take this woman and her child into your home, your heart, your relationships and your retirement life, and then wonder every day how this once ungrateful stepdaughter could become the loving stepdaughter who gave birth to the most wonderful, sweet, smart child, who brightens your days of retirement and makes it all seem worth it.

The final word:As someone who enjoys her privacy to a sometimes pathological degree (it can involve throwing ringing phones across the room and crouching behind curtains when the doorbell rings), I sympathize with your plight. Your home is your sanctuary, after all, a peaceful retirement hard-earned and much-anticipated, I don’t doubt. But I’d like to point out a couple of things. One, you married a man who made it clear his daughter was his priority. In agreeing to join your life with his, you’ve essentially agreed to participate, in the usual wifely way, in his family relationships. That includes any responsibilities he may feel he has toward his daughter.

Two, you say you’ve always found this woman “lazy and disorganized.” I agree with Jean this isn’t exactly unconscionable; furthermore, I can’t help but notice you cite her current age as 21. Which tells me you’ve probably known this girl primarily during her teenage years. Show me a teenager who isn’t lazy and disorganized and I will show you Reese Witherspoon in the film Election, or else an even smaller, shriller version of Rachael Ray. Just count yourself lucky you never had to put up with that kind of type-A irritation.

And now comes the all-kidding-aside portion of my response. All kidding aside, this woman is barely out of her teens, obviously in a transitional period and about to have a baby. Her father, who loves her, has a finished basement sitting empty in his house. Penelope calls the situation a “deal-breaker” – and I feel fortunate not to be related to Penelope. To me, it’s a no-brainer. Can you actually suppose your stepdaughter and her husband yearn to raise their child huddled around Dad’s furnace the rest of their lives? Can you possibly imagine a bigger motivator than rocking your infant as you squint at the thin trickle of sunshine coming in from the minuscule window, while listening to your hostile stepmother stomp around directly above your head? Trust me. They will be out within the year. If you doubt this, you are perfectly within your rights to ask your husband to provide his daughter and her new family with a deadline. Meanwhile, you may consider taking Eric’s advice about opening not only your basement, but your heart, just a titch.

***************************************************************************

Friends describe elderly suspect's desperation, Feb 13 2010.

A 73-year-old grandfather, once a proud engineer at the Port of Tampa, is in jail, charged with a string of bank robberies. Police say he told them he was trying to pay his mortgage. His friends never thought it would come to this. Police say 73-year-old James Bruce was so desperate for money, he convinced himself he could just pay the banks back when he got back on his feet.

Bruce and his wife had fallen behind on a second mortgage taken on their south Tampa home to buy a business, according to investigators. But hard times and cold weather meant few wanted the expensive pots he and his wife sold on Westshore Boulevard.

He'd been to the salon next door.

"He did ask me for money, he asked me for ten dollars, actually that's all he asked for," said Delia Urrutia.

Officers say Bruce confessed to robbing three South Tampa banks in as many weeks, each time slipping the tellers a note demanding $600.

His arrest came less than 24 hours after police released this surveillance video from Wednesday's hold up. He didn't use a disguise or carry a weapon.

Those close to Bruce knew he was teetering on the edge. An old friend who'd moved his business up to Hillsborough Avenue said Bruce started driving all the way from south Tampa asking for help.

Steve Judeh, a friend for 17 years, said Bruce never asked for help until recently.

"It was heartbreaking," Judeh said. "I gave him some money, and I gave him some cigarettes and some gas, but he kept on calling me two to three times a week asking for my money, and with the economy the way it is, I can only do so much," Judeh said.

Held on $22,500 bond, Bruce seemed confused in court, walking in a slow shuffle, grabbing a bench for balance, and even touching the arresting detectives' heart.

"He's 73 years old, he's trying to keep his family in their home, but you can't go about it by robbing a bank," said TPD detective Rachel Cholnik.

***************************************************************************

Bees get buzz around caffeine, nicotine, Mark Rebacz, Feb 2 2010.

University of Haifa study finds bees prefer nectar with caffeine and nicotine to nectar without. A recent University of Haifa study has found that bees prefer nectar with a small concentration of caffeine and nicotine to nectar without.

“This could be an evolutionary trait intended to make the bee addicted,” said Prof. Ido Yitzchaki, who headed the study.

The research, conducted at the university’s biology department in Oranim, showed that bees clearly prefer nectar containing nicotine and caffeine over the “clean” nectar. The preferred nicotine concentration was 1 milligram per liter, similar to that found in nature. But, as opposed to humans, the bees do not seem likely to overdose, as the study found that the bees reject nectar containing higher levels of nicotine.

“The purpose of nectar, among other aspects of the flower,” said Yitzchaki, “is to attract insects, which subsequently disseminate the flower’s pollen, ultimately enabling the flower to reproduce”. This is also the reason for flowers’ bright colors and scented aroma, he says.

Scientists, however, began to discover traces of toxins in flowers’ nectar, such as caffeine and nicotine, the latter lethal in high enough doses.

So if evolution is at work, why would flowers have toxins in their alluring potion? The answer, Yitzchaki discovered, is that these toxins attractbees, just as they do humans. But this is not to say that bees become addicted like humans do. To prove addiction, other factors, such as ever-increasing consumption, and withdrawal symptoms need to be present, qualities difficult to examine inbees.

According to the researchers, it is not yet clear whether the addictive substances in the nectar became present in an evolutionary process in order to make pollination more efficient. However, it can be assumed, they say, that the plants that survived natural selection are those that developed “correct” levels of these addictive substances, enabling them to attract bees, thus giving them a significant advantage over other plants.

Yitzchaki hopes to conduct future stages of this study to determine whether or not the bees truly are addicted, or just have a sweet tooth for caffeine and nicotine.

***************************************************************************

Why bees are partial to coffee and cigarettes - they may be addicted, Feb 11 2010.

Many people feel they need a cigarette and a cup of coffee to start the day and now it turns out bees are no different.

The honey-making insects prefer nectar with small amounts of nicotine and caffeine over plain nectar, researchers revealed today.

Flower nectar is primarily comprised of sugars, which provides energy for the potential pollinators. But the floral nectar of some plant species also includes small quantities of substances known to be toxic, such as caffeine and nicotine.

The scientists from the University of Haifa examined whether the substances were intended to 'entice' bees or whether they were byproducts with no particular role.

'This could be an evolutionary development intended, as in humans, to make the bee addicted,' said lead researcher Professor Ido Izhaki.

Nicotine is found naturally in floral nectar mostly in types of tobacco tree, while caffeine is found in citrus flowers - especially those of grapefruit.

In order to examine whether bees prefer the nectar containing caffeine and nicotine, the researchers offered artificial nectar that comprised various natural sugar levels and various levels of caffeine and nicotine, alongside 'clean' nectar that comprised sugar alone.

The caffeine and nicotine concentrations ranged from the natural levels in floral nectar up to much higher concentrations than found in nature.

The results showed that bees preferred the nectar with the highest levels of nicotine and caffeine.

According to the researchers, it is difficult to determine for sure whether the addictive substances in the nectar became present in an evolutionary process in order to make pollination more efficient.

It can be assumed, however, based on the results of the study, that the plants that survived natural selection are those that developed 'correct' levels of these addictive substances, enabling them to attract and not repel bees, thereby giving them a significant advantage over other plants.

The researchers emphasized that this study has proved a preference, not addiction, and they are currently examining whether the bees do indeed become addicted to nicotine and caffeine.

***************************************************************************

Abelhas podem ser viciadas em 'café e cigarros', 13 fev 2010.

As abelhas não são muito diferentes de algumas pessoas que não conseguem começar o dia sem uma xícara de café e um cigarro. Uma pesquisa da Universidade de Haifa, de Israel, revelou nesta quinta-feira (11) que esses insetos preferem néctar com pequenas quantidades de nicotina e cafeína ao néctar puro.

O néctar da flor é composto principalmente de vários tipos de açúcar, que fornecem energia para as abelhas. Mas o néctar da flor de algumas espécies de plantas também possui pequenas quantidades de substâncias tóxicas, como a cafeína e a nicotina.

Os cientistas resolveram descobrir "se essas substâncias tinham sido 'feitas' para atrair as abelhas ou se eram apenas subprodutos sem um papel definido", explicou o chefe da pesquisa, o professor Ido Izhaki.

Na natureza, a nicotina é encontrada no néctar floral de alguns tipos de árvore de tabaco enquanto a cafeína aparece em flores cítricas, principalmente na toranja (grapefruit).

Para examinar se as abelhas preferem o néctar com cafeína e nicotina, os pesquisadores ofereceram néctar artificial contendo vários níveis de açúcar natural e vários níveis de cafeína e nicotina, junto com uma porção de néctar “limpo” só com açúcar.

As concentrações de cafeína e a nicotina variaram dos níveis naturais encontrados no néctar floral até concentrações muito mais altas do que as encontradas na natureza.

Os resultados revelaram que as abelhas preferiram o néctar com os mais altos níveis de nicotina e cafeína.

De acordo com os pesquisadores, é difícil determinar com certeza se as substâncias viciantes presentes no néctar se tornaram presentes ao longo do tempo para tornar a polinização mais eficiente.

Mas, a partir do estudo, os cientistas concluíram que as plantas que sobreviveram ao tempo são aquelas que desenvolveram níveis “corretos” dessas substâncias viciantes. O que permitiu a elas atrair e não repelir as abelhas, dando-lhes uma maior vantagem sobre as outras plantas.

Os pesquisadores disseram que o estudo provou a preferência, não o vício, e que agora estão estudando se as abelhas se tornaram mesmo viciadas em nicotina e cafeína.

***************************************************************************

Journal of Ecological Complexity: Social complexity and sustainability, Joseph Tainter, 4 May 2005.

ABSTRACTSocial complexity and sustainability emerge from successful problem solving, rather than directly from environmental conditions. Social complexity develops from problem solving at all scales from local to national and international. Complexity in problem solving is an economic function, and can both support and hinder sustainability. Sustainability outcomes may take decades or centuries to develop. Historical studies reveal three outcomes to long term change in problem-solving institutions: collapse, resiliency through simplification, or continuity based on growing complexity and increasing energy subsidies. The slow development of complexity in problem solving makes its effects difficult to perceive, especially over short time periods. Long-term social sustainability depends on understanding and controlling complexity. New strategies to mitigate or control complexity are offered.

1. IntroductionThe contemporary science of complexity extends an intellectual tradition developed in the older fields of systems theory and information theory (e.g., Shannon and Weaver, 1949; Ashby, 1956; Brillouin, 1956; von Bertalanffy, 1968). A premise of these fields is that diverse kinds of systems display commonalities in structure, organization, and behavior that make it possible to generalize across otherwise disparate types of phenomena. Perhaps the greatest accomplishment of this approach came in the 1970s, when Miller (1978) developed a comprehensive synthesis in which he reduced the structure and organization of living systems to a few common components, such as boundaries, reproducers, matter-energy processors, and information processing subsystems. The sciences of complexity that coalesced in the research of the Santa Fe Institute (e.g., Gleick, 1987; Kauffman, 1993), in hierarchy theory (e.g., Simon, 1965; Pattee, 1973; Allen and Starr, 1982; Allen and Hoekstra, 1992; Ahl and Allen, 1996), and in the approach that Holling and Gunderson label ‘‘panarchy’’ (Holling, 2001; Holling and Gunderson, 2002; Holling et al., 2002) have continued and updated the tradition of searching for cross-system regularities.

Yet cross-system generalizations have limits, and the points at which they fail may suggest insights that are not achievable in a comparative framework. While it is possible to compare ecological and social systems in some dimensions, the origins of complexity in each type of system, and the relationship of complexity to sustainability, are often very different. There has been, for example, a tradition within ecology to equate complexity with diversity, and diversity with stability or sustainability. This line of reasoning is several decades old (e.g., Odum, 1953; Elton, 1958; May, 1972), yet still of widespread interest (McCann, 2000; Loehle, 2004). Diversity and complexity emerge in an ecological system from available energy and water, and from competition, which stimulate speciation or support immigration (Schneider and Kay, 1994; Allen et al., 2003, pp. 331, 335, 341; Jørgensen and Fath, 2004). As species develop to tap unused energy, or immigrate from elsewhere, increases in diversity and redundancy of structure and function, it is argued, give rise to stability (McCann, 2000, pp. 230–232).

Much as the availability of energy in an ecosystem generates greater diversity in structure and organization, it was once thought that human social complexity emerged from surplus energy. The assumptions underpinning this view have rarely been explored. The fundamental assumption is that cultural complexity is desirable, and that people will develop it given the opportunity (that is, surplus energy). This view is now known to be naive (e.g., Tainter, 1988, 2000b). As discussed below, not only are humans not prone to complexity, we are in many situations averse to it.

In a human system, the relationship of complexity to stability or sustainability is more nuanced than simply equating diversity with stability. Complexity often compels the production of energy, rather than following its abundance. Social complexity both enhances and undermines sustainability, depending on a number of factors that it is my purpose here to describe (see also Tainter, 1988, 1995, 2000b; Allen et al., 2003). In a human society, complexity is linked fundamentally and inextricably to sustainability, but that relationship is neither simple, nor direct, nor constant.

2. DefinitionsCollapse, complexity, sustainability, and resiliency are common terms, yet are frequently offered without definition, or with definitions that are less than useful (Tainter, 2001, pp. 349–350; Allen et al., 2003, pp. 24–26). I have previously defined sociopolitical collapse as a rapid simplification, the loss of an established level of social, political, or economic complexity (Tainter, 1988, 1999). Complexity is more challenging to define singularly. As it has become a popular topic in recent years, competing definitions of complexity have made it difficult to clarify the concept. The nuances of these different conceptions are not helpful in understanding the relationship of social complexity to sustainability; those interested may consult the growing literature on this topic. To understand sustainability, it is useful to conceptualize complexity in human social systems as differentiation in both structure and behavior, and/or degree of organization or constraint (Tainter, 1988, 2000b; Allen et al., 2003; see also Allen et al., 1999). Social systems vary in complexity as they diversify or contract in structure and behavior, and/or as they increase or decrease in organizational constraints on behavior.

The definition of sustainability most widely cited was offered in 1987 by Gro Harlem Bruntland, then Prime Minister of Norway: ‘‘Sustainable development is development that meets the needs of the present without compromising the ability of future generations to meet their own needs’’ (World Commission on Environment and Development, 1987, p. 43). While this definition will no doubt continue to be widely cited, it has limited operational usefulness. Befitting a political leader, the definition is too general to guide behavior. It is so vague ‘‘. . . as to be consistent with almost any form of action (or inaction)’’ (Pearce et al., 1994, p. 457).

The Oxford English Dictionary lists twelve definitions of ‘‘sustain,’’ of which two seem especially pertinent. Number four, deriving from Middle English, reads ‘‘To keep in being; to continue in a certain state; to keep or maintain at the proper level or standard; to preserve the status of.’’ Number six, from about 1700, is ‘‘To support life in; to provide for the life or bodily needs of; to furnish with the necessities of life; to keep’’ (Orions, 1955, p. 2095). This later definition is consistent with, indeed underpins, biologists’ conceptions of sustainability: the maintenance of ecosystems and life-support systems. These definitions are not mutually exclusive. They could be merged to achieve a unified conception of sustainability (e.g., ‘‘to keep or maintain by furnishing the necessities of life’’). The older definition, though, is more consistent with common usage. Since sustainability depends ultimately on the population at large, common conceptions of sustainability must be acknowledged. People sustain what they value, which can only derive from what they know. Ask people what they wish to sustain, and the answer will always involve positive or valued parts of their current way of life. For example, conflict between environmental advocates and rural people who live by natural resource production is not just about ecology versus economics. The conflict is also about sustaining a way of life (Tainter, 2001, 2003).

Resiliency is a concept that is much discussed today (e.g., Holling, 2001; Holling and Gunderson, 2002; Holling et al., 2002). Given the discussion above, it is important to distinguish sustainability from resiliency. Sustainability is the capacity to continue a desired condition or process, social or ecological. Resiliency is the ability of a system to adjust its configuration and function under disturbance. In social systems, resiliency can mean abandoning sustainability goals and the values that underlie them. Sustainability and resiliency can conflict (Allen et al., 2003, p. 26).

The goal of human groups is more often sustainability or continuity than resilience. Most of us prefer the comfort of an accustomed life (sustainability) to the adventure of dramatic change (resiliency). We find it difficult to recognize, let alone alter, the ingrained values that underlie our sustainability goals. A fully resilient society would be a valueless one, which by definition cannot be. Nevertheless, resiliency is evident in human history, and important to understand when it occurs. An important case study in resiliency is described below.

3. Social complexity and problem solvingIt is common to think of social sustainability as a direct function of ecological support systems. If the environment cannot deliver the products and services on which people depend, social sustainability will presumably decline. Environmental deterioration is one of the most common explanations for the collapse of ancient societies (summarized in Tainter, 1988, 2000a). Yet the relationship of ecosystem structure and function to social sustainability is not simple or direct. Changes that an ecologist might characterize as degradation may, for a human population, constitute merely a change in the opportunity spectrum.

Degradation is often taken to be the opposite of sustainability. Yet it manifests itself in counterintuitive ways. Sander van der Leeuw and his colleagues have studied degradation across parts of Europe and the Mediterranean Basin. van der Leeuw points out that degradation is a social construct. It has no absolute references in biophysical processes. In the Vera Basin of Spain degradation manifests itself in erosion, a common understanding of the term. In Epirus, in the northwest of Greece, however, degradation appears as an increase of scrub vegetation that chokes off a formerly open landscape. A centuries-old pastoral life, in which local villages were sustainably self-sufficient, is now impossible. To urban residents the landscape now appears ‘‘natural,’’ but to Epirotes it has been degraded. Moreover the spread of shrub and tree cover has reduced the supply of groundwater and the flow of springs. As mountain vegetation thrives that lower down declines. When soil is eroded from the Epirote mountains it forms rich deposits in valleys that have sustained agriculture for millennia (van der Leeuw, 1998; van der Leeuw et al., 2000; Bailey et al., 1998; Bailiff et al., 1998; Green et al., 1998). Here mountaintop species have suffered while agroecosystems thrived, and the contrast with erosion in the Vera Basin is profound. It is clear in these examples that in the realm of sustainability and degradation there are winners and losers. Far from being rigidly linked to biophysical processes, these terms mean what people need them to mean in specific circumstances.

The relationship of environmental condition to human sustainability is indirect and subtle. The relationship is mediated by human capacities in problem solving. Sustainability is not the achievement of stasis. It is not a passive consequence of having fewer humans who consume more limited resources. One must work at being sustainable. The challenges to sustainability that any society (or other institution) might confront are, for practical purposes, endless in number and infinite in variety. This being so, sustainability is a matter of problem solving, an activity so commonplace that we perform it with little reflection. Rarely does science address itself to understand problem solving, or its long-term consequences.

The success of problem solving rests to a great degree of the complexity of the effort and, over the long term, on understanding and controlling this complexity. If there is a generalization on which most historians would agree, it is that human societies of the past 12,000 years have, on average and in many specific instances, greatly increased in size and complexity. The components of this trend include growing populations; greater technical abilities; hierarchy; differentiation and specialization in social roles; greater scales of integration; and increasing production and flow of information. We usually think that our success as a species comes from such characteristics as upright posture, an opposable thumb, and a large and richly networked brain. We are successful in large part because these features allow us rapidly to increase the complexity of our behavior. Any number of measures could be summoned to show that, in at least the industrial world, human well-being has in recent decades benefited from this trend. Perhaps the most unequivocal of such measures is the increase in average health and lifespan of the past two centuries. We are, on balance, better off for having grown complex. Complexity clearly has great utility in problem solving.

At the same time, we are paradoxically averse to complexity. In 4 million years of hominid existence, complexity is recent and rare. This is because every increase in complexity has a cost. The cost of complexity is the energy, labor, money, or time that is needed to create, maintain, and replace systems that grow to have more and more parts, more specialists, more regulation of behavior, and more information. Before the development of fossil fuels, increasing the complexity and costliness of a society meant that people worked harder.

Thus, the development of complexity is a wonderful dilemmas of human history. Over the past 12,000 years, we have responded to challenges with strategies that cost more labor, time, money, and energy, and that go against our aversion to such costs. We have done this because most of the time complexity works. It is a basic problem-solving tool. Confronted with problems, we often respond by developing more complex technologies, establishing new institutions, adding more specialists or bureaucratic levels to an institution, increasing organization or regulation, or gathering and processing more information. Such increases in complexity work in part because they can be implemented rapidly, and typically build on what was developed before. While we usually prefer not to bear the cost of complexity, our problem solving efforts are powerful complexity generators. All that is needed for growth of complexity is a problem that requires it. Since problems continually arise, there is persistent pressure for complexity to increase.

The costliness of complexity is not a mere annoyance or inconvenience. It conditions the long-term success or failure of problem-solving efforts. Complexity can be viewed as an economic function. Societies and institutions invest in problem solving, undertaking costs and expecting benefits in return. In any system of problem solving, early efforts tend to be simple and cost-effective. That is, they work and give high returns per unit of effort. This is a normal economic process: humans always tend to pluck the lowest fruit, going to higher branches only when those lower no longer hold fruit. In problem-solving systems, inexpensive solutions are adopted before more complex and expensive ones. In the history of human food-gathering and production, for example, labor-sparing hunting and gathering gave way to more labor-intensive agriculture, which in some places has been replaced by industrial agriculture that consumes more energy than it produces (Boserup, 1965; Clark and Haswell, 1966; Cohen, 1977). We produce minerals and energy whenever possible from the most economic sources. Our societies have changed from egalitarian relations, economic reciprocity, ad hoc leadership, and generalized roles to social and economic differentiation, specialization, inequality, and full-time leadership. These characteristics are the essence of complexity, and they increase the costliness of any society.

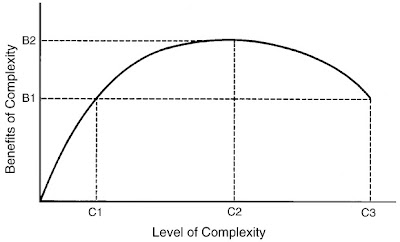

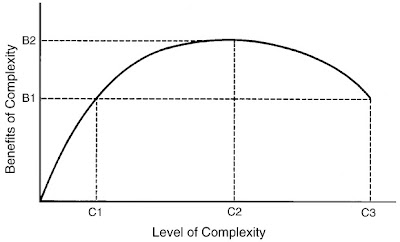

Fig. 1 – The marginal productivity of increasing complexity. At a point such as B1, C3, the costs of complexity exceed the benefits, and complexity is a disadvantageous approach to problem solving (after Tainter, 1988, p. 119).

As high-return solutions are progressively implemented, only more costly solutions remain. As the highest-return ways to produce resources, process information, and organize society are applied, continuing problems must be addressed in ways that are more costly and less cost-effective. As the costs of solving problems grow, the point is reached where further investments in complexity do not give a proportionate return. Increments of investment in complexity begin to yield smaller and smaller increments of return. The marginal return (that is, the return per extra unit of investment) starts to decline (Fig. 1). This is the long-term challenge faced by problem solving institutions: diminishing returns to complexity. If allowed to proceed unchecked, eventually it brings ineffective problem solving and even economic stagnation. In the most pernicious form, diminishing returns to complexity have made societies vulnerable to collapse (Tainter, 1988, 1999). A prolonged period of diminishing returns to complexity is a major part of what makes problem solving ineffective and societies or institutions unsustainable.

This principle can be illustrated in two primary areas of problem solving: producing resources and producing information. In the following examples, people solve the problems of obtaining resources and producing information in ways that are economically rational. They prefer behavior and institutions that are inexpensive. When problems require new ways of meeting their needs, they adopt increasing complexity and experience diminishing returns. This discussion illustrates the path typically followed by problem-solving institutions: increasing complexity, increasing costliness, and diminishing returns to complexity.

3.1. Producing resourcesThe members of industrial societies are socialized to think that it is normal to produce as much as possible. Maximizing production is, however, a recent development. Our ancestors typically produced much less than they were capable of, and many people still do. When anthropologist Richard Lee studied the !Kung Bushmen of the Kalahari Desert, he found them working only 2.5 days per week to obtain all the food they needed (Lee, 1968, 1969). With a little extra effort they could have produced more, but preferred to spend their time at leisure.

Subsistence farmers also tend to under produce, so that labor is underutilized and inefficiently deployed. Posposil (1963) observed Kapauku Papuans of New Guinea, for example, working only about 2 h a day at agriculture. Robert Carneiro found that Kuikuru men in the Amazon Basin spend 2 h each day at agricultural work and 90 min fishing. The remainder of the day is spent in social activities or at rest. With a little extra effort such people could produce much more than they do (Sahlins, 1972).

Subsistence farmers in more economically developed places have followed similar reasoning, including peasants of pre-revolutionary Russia. A.V. Chayanov studied the intensity of labor among 25 families in the farming community of Volokolamsk. Chayanov found that the larger the relative number of workers per household, the less work each person performed. Productive intensity in Volokolamsk varied inversely with productive capacity (Sahlins, 1972, p. 91). Even under the harsh conditions in which they lived, these Russian peasants under produced. Those able to produce the most actually under produced the most. They valued leisure more highly than the marginal return to extra labor.

The economist Ester Boserup confronted this dilemma in her classic work The Conditions of Agricultural Growth (1965). She argued that the key to persistent underproduction is the marginal productivity of labor. While intensification in non-mechanized cultivation causes the productivity of land to increase, it causes the productivity of labor to decline. Each extra unit of labor produces less output per unit than did the first unit of labor. Kapauku Papuans, Kuikuru, Russian peasants, and other subsistence farmers produce less than they might for the simple reason that increasing production yields diminishing returns to labor.

Boserup’s argument has been well verified. In northern Greece, for example, labor applied at an annual rate of about 200 h per hectare is about 15 times more productive (in returns to labor) than labor applied at 2000 h per hectare. The latter farmer will certainly harvest more per hectare, but will harvest less per hour of work (Clark and Haswell, 1966; Wilkinson, 1973). Sometimes subsistence intensification might amount only to the application of extra labor. In other cases it means increasing the complexity of subsistence production by adding extra steps such as field preparation, weeding, manuring, fallowing, or irrigation.

The principle is exemplified in other systems of production. The American dairy industry, for example, began to practice more intensive dairying between 1850 and 1910. The major changes were extending dairying into the winter months, better feeding, and improved sanitation. Annual yield per cow improved by 50%, but output per unit of labor declined by 17.5% (Bateman, 1969).

In sectors such as energy and minerals production, it is a truism that the most accessible deposits are mined first, so that continued exploitation axiomatically yields lower returns per unit of effort. In the case of energy, the dilemma is energy return on investment, where the ratio of BTUs extracted to BTUs invested continually deteriorates (Hall et al., 1992).

3.2. Producing knowledgeInformation is central to sustainability. Producing knowledge has as great a role in problem solving as producing resources. Yet information also has costs. As knowledge grows more complex, its production becomes subject to diminishing returns. This constraint limits its application to problem solving.

Education provides one example. As any society increases in complexity it becomes more dependent on information, and its members require higher levels of education. In 1924, S.G. Strumilin evaluated the productivity of education in the nascent Soviet Union. He found that the first 2 years of education raise a worker’s skills an average of 14.5% per year. A third year of education causes its productivity to decline, for skills rise only an additional 8%. Four to six years of education raise workers’ skills only an additional 4–5% per year (Tulchinskii, 1967, pp. 51–52).

Fig. 2 – Productivity of educational investment for producing specialized expertise, U.S., 1900–1960 (data from Machlup, 1962, pp. 79 and 91).

A comprehensive study of the costs of education in the United States was published by Fritz Machlup (1962). In 1957–1958, home education of pre-school children cost the United States $886,400,000 per year for each age class from newborn through 5 (primarily potential income foregone by parents). In elementary and secondary school the costs increased to $2,564,538,462 per year per age class (for ages 6 through 18). For those who aspired to higher education (33.5% of the eligible population in 1960), a 4-year course of study cost the nation $3,189,250,000 per grade per year. Thus, the monetary cost of education between pre-school, when the most general and broadly useful education takes place, and college, when the learning is most specialized, increased in the late 1950s by 1075% per capita. Yet from 1900 to 1960 the productivity of this investment for producing specialized expertise declined throughout (Fig. 2). As S.G. Strumilin found in the Soviet Union in 1924, higher levels of educational investment yield declining marginal returns.

Science is humanity’s ultimate exercise in problem solving. The knowledge developed early in a scientific discipline tends to be generalized and inexpensive to produce. Thereafter the work becomes increasingly specialized. Specialized research tends to be more costly and difficult to resolve, so that increasing investments yield declining marginal returns. As easier questions are resolved, science moves inevitably to more complex research topics and to more costly organizations.

Fig. 3 – Patent applications in respect to research inputs, U.S., 1942–1958 (data from Machlup, 1962, p. 173).

If we evaluate the productivity of our investment in science by some measure such as the issuance of patents (Fig. 3), the long-term productivity of applied research seems to be declining. Patenting is a controversial measure of productivity (e.g., Machlup, 1962, pp. 174–175; Schmookler, 1966; Griliches, 1984), but there is good evidence in the field of medicine, where the return to investment can be readily determined. Over the 52-year period shown in Fig. 4, from 1930 to 1982, the productivity of the United States health care system for improving life expectancy declined by nearly 60%.

Fig. 4 – Productivity of the U.S. health care system, 1930–1982 (data from Worthington [1975, p. 5] and U.S. Bureau of the Census (1983, pp. 73 and 102)). Productivity index = (Life expectancy)/(National health expenditures as percent of GNP).

The declining productivity of the U.S. health care system illustrates clearly the historical development of problem solving systems. The productivity of medicine is declining because the inexpensive diseases and ailments were conquered first. The basic research that led to penicillin, for example, cost no more than $20,000. The remaining maladies are more difficult and costly to cure. As each increasingly expensive disease is conquered, the increment to average life expectancy becomes ever smaller. The marginal return to medical investment progressively declines (Rescher, 1978, 1980).

3.3. Summary: problem solving and sustainabilityHuman institutions are always, in part, problem-solving systems, and the major problem they face is sustaining themselves. Problem solving is an economic process, in which costs are assumed and benefits gained. Efforts at problem solving, as seen in the examples of producing resources and producing information, commonly evolve along a path of increasing complexity, higher costs, and declining marginal returns. Ultimately the problem solving effort may grow so cumbersome, costly, and ineffective that it is either terminated, collapses, or requires large subsidies. Yet commonly when the solution to a problem is decided upon, it is a rational, short-term measure. The higher complexity and cost of implementing the solution appear incremental and affordable. The damage comes from cumulative and long-term effects, which typically are unforeseen.

This is the key to understanding the development of unsupportable complexity in problem solving: it grows perniciously, by small steps, each necessary, each a reasonable solution, yet each cumulative. Each increment of complexity builds on what was done before, so that complexity seems to grow exponentially. Such a trend clearly cannot continue indefinitely.

Environmental constraints affect human sustainability through problem solving. Environmental problem solving that generates complexity and high costs will in time prove unsupportable (Tainter, 1997, 2003; Allen et al., 2003). Thus, the question of social sustainability concerns not merely the state of an environmental system, but also whether the institutions that address environmental issues are effective problem-solvers. In the next section I briefly describe three cases of long-term trends in problem solving that produced quite different outcomes. The cases are historical, yet the outcomes are pertinent today. The cases describe problem solving in relation to the political environment, but illustrate general trends that apply as well to problem solving in the biophysical environment.

4. Studies in collapse, resiliency, and sustainabilityLong-term developments in problem solving can have divergent outcomes, and these outcomes have revealing implications for sustainability. To illustrate these implications three case studies are briefly discussed: the fifth century AD collapse of the Western Roman Empire, the revival of the Byzantine Empire after the seventh century, and European warfare of the past half millennium. These cases clarify possible outcomes for present and future problem solving. The case studies described below are condensed from more extensive treatments (Tainter, 1988, 1994, 2000b; Allen et al., 2003), which may be consulted for further details.

4.1. Collapse of the western Roman EmpireThe economics of an empire such as the Romans assembled are seductive but illusory. The returns to any campaign of conquest are highest initially, when the accumulated surpluses of the conquered peoples are appropriated. Thereafter the conqueror assumes the cost of administering and defending the province. These responsibilities may last centuries, and are paid for from yearly agricultural surpluses (Tainter et al., 2003).

Fig. 5 – Debasement of the denarius to 269 AD (data from Cope (1969, 1974, and unpublished analyses on file in the British Museum), King (1982), Le Gentilhomme (1962), Tyler (1975), and Walker (1976, 1977, 1978); see also Besly and Bland (1983, pp. 26–27) and Tainter (1994, p. 1217)).

The Roman government was financed by agricultural taxes that barely sufficed for ordinary administration. When extraordinary expenses arose, typically during wars, the precious metals on hand frequently were insufficient. Facing the costs of war on the eastern frontier with Parthia and rebuilding Rome after the Great Fire, Nero began in 64 AD a policy that later emperors found irresistible. He debased the primary silver coin, the denarius, reducing the alloy from 98 to 93% silver. It was the first step down a slope that resulted two centuries later in a currency that was worthless and a government that was insolvent (Fig. 5).

In the half-century from 235 to 284 the empire nearly came to an end. There were foreign and civil wars almost without interruption. The period witnessed 26 legitimate emperors and perhaps 50 usurpers. Cities were sacked and frontier provinces devastated. The empire shrank in the 260s to Italy, the Balkans, and North Africa. By prodigious effort the empire survived the crisis, but it emerged at the turn of the fourth century AD as a very different organization.

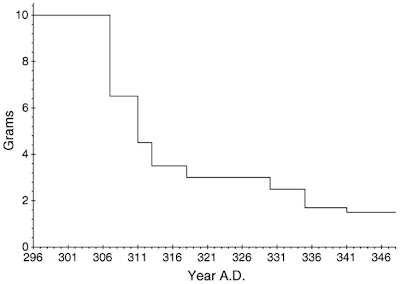

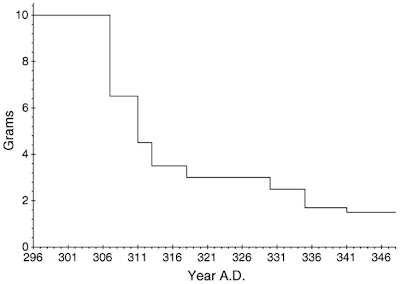

Fig. 6 – Reductions in the weight of the Roman follis, 296–348 AD (data from Van Meter, 1991, p. 47).

In response to the crises, the emperors Diocletian and Constantine, in the late third and early fourth centuries, designed a government that was larger, more complex, and more highly organized. They doubled the size of the army. To pay for this the government taxed its citizens more heavily, conscripted their labor, and dictated their occupations. Villages were responsible for the taxes on their members, and one village could even be held liable for another. Despite several monetary reforms a stable currency could not be found (Fig. 6). As masses of worthless coins were produced, prices rose higher and higher. Money changers in the east would not convert imperial currency, and the government refused to accept its own coins for taxes.

With the rise in taxes, population could not recover from plagues in the second and third centuries. There were chronic shortages of labor. Marginal lands went out of cultivation. Faced with taxes, peasants would abandon their lands and flee to the protection of a wealthy landowner. By 400 AD most of Gaul and Italy were owned by about 20 senatorial families.

From the late fourth century the peoples of central Europe could no longer be kept out. They forced their way into Roman lands in western Europe and North Africa. The government came to rely almost exclusively on troops from Germanic tribes. When finally they could not be paid, they overthrew the last emperor in Italy in 476 (Boak, 1955; Russell, 1958; Jones, 1964, 1974; Hodgett, 1972; MacMullen, 1976; Wickham, 1984; Williams, 1985; Tainter, 1988, 1994; Duncan-Jones, 1990; Williams and Friell, 1994; Harl, 1996).

The strategy of the later Roman Empire was to respond to a near-fatal challenge in the third century by increasing the size, complexity, power, and costliness of the primary problem solving system—the government and its army. The higher costs were undertaken not to expand the empire or to acquire new wealth, but to maintain the status quo. The benefit/cost ratio of imperial government declined. In the end the Western Roman Empire could no longer afford the problem of its own existence.

4.2. The early Byzantine recoveryThe Eastern Roman Empire (usually known as the Byzantine Empire) survived the fifth century debacle. Efforts to develop the economic base, and to improve the effectiveness of the army, were so successful that by the mid sixth century Justinian (527–565) could engage in a massive building program and attempt to recover the western provinces.

By 541 the Byzantines had conquered North Africa and most of Italy. Then that year bubonic plague swept over the Mediterranean for the first time. Just as in the fourteenth century, the plague of the sixth century killed from one-fourth to one-third of the population. The loss of taxpayers caused immediate financial and military problems. In the early seventh century the Slavs and Avars overran the Balkans. The Persians conquered Syria, Palestine, and Egypt. Constantinople was besieged for 7 years.

Fig. 7 – Weight of the Byzantine follis, 498–717 AD (data from Harl, 1996, p. 197).

The emperor Heraclius cut pay by half in 616, and proceeded to debase the currency (Fig. 7). These economic measures facilitated his military strategy. In 626 the siege of Constantinople was broken. The Byzantines destroyed the Persian army and occupied the Persian king’s favorite residence. The Persians had no choice but to surrender all the territory they had seized. The Persian war lasted 26 years, and resulted only in restoration of the status quo of a generation earlier.

The empire was exhausted by the struggle. Arab forces, newly converted to Islam, defeated the Byzantine army decisively in 636. Syria, Palestine, and Egypt, the wealthiest provinces, were lost permanently. The Arabs raided Asia Minor nearly every year for two centuries, forcing thousands to hide in underground cities. Constantinople was besieged each year from 674 to 678. The Bulgars broke into the empire from the north. The Arabs took Carthage in 697. From 717 to 718 an Arab force besieged Constantinople continuously for over a year. It seemed that the empire could not survive. The city was saved in the summer of 718, when the Byzantines ambushed reinforcements sent through Asia Minor, but the empire was now merely a shadow of its former size.

Third and fourth century emperors had managed a similar crisis by increasing the complexity of administration, the regimentation of the population, and the size of the army. This was paid for by such levels of taxation that lands were abandoned and peasants could not replenish the population. Byzantine emperors could hardly impose more of the same exploitation on the depleted population of the shrunken empire. Instead they adopted a strategy that is truly rare in the history of complex societies: systematic simplification.

Around 659 military pay was cut in half again. The government had lost so much revenue that even at one fourth the previous rate it could not pay its troops. The solution was for the army to support itself. Soldiers were given grants of land on condition of hereditary military service. The Byzantine fiscal administration was correspondingly simplified.

The transformation ramified throughout Byzantine society. Both central and provincial government were simplified, and the costs of government were reduced. Provincial civil administration was merged into the military. Cities across Anatolia contracted to fortified hilltops. The economy developed into its medieval form, organized around self-sufficient manors. There was little education beyond basic literacy and numeracy, and literature itself consisted of little more than lives of saints. The period is sometimes called the Byzantine Dark Age.

The simplification rejuvenated Byzantium. The peasant soldiers became producers rather than consumers of the empire’s wealth. By lowering the cost of military defense the Byzantines secured a better return on their most important investment. Fighting as they were for their own lands and families, soldiers performed better.

During the eighth century the empire re-established control of Greece and the southern Balkans. In the tenth century the Byzantines reconquered parts of coastal Syria. Overall after 840 the size of the empire was nearly doubled. The process culminated in the early eleventh century, when Basil II conquered the Bulgars and extended the empire’s boundaries again to the Danube. The Byzantines went from near disintegration to being the premier power in Europe and the Near East, an accomplishment won by decreasing the complexity and costliness of problem solving (Treadgold, 1988, 1995, 1997; Haldon, 1990; Harl, 1996).

4.3. Complexity and sustainability in renaissance and modern EuropeArms races are the classic example of diminishing returns to complexity. Any competitive nation will quickly match an opponent’s advances in armaments, personnel, logistics, or intelligence, so that investments typically yield no lasting advantage or security. The costs of being a competitive state continuously rise, while the return on investment inexorably declines.

In Europe of the fifteenth century, siege guns ended the advantage of stone castles. Fortifications were developed that could support defensive cannon and that could also survive bombardment. These new fortifications featured low, thick walls with angled bastions and extensive outworks. They were effective but expensive: Siena built such fortifications against Florence, but was annexed anyway when no money was left for its army.

Open-field warfare also developed greater complexity. Massed archers and the pike phalanx made the armored knight obsolete. These were soon superseded by firearms. Effective use of firearms took organization and drill. Victory came to depend not on simple force, but on the right combination of infantry, cavalry, firearms, cannon, and reserves.

War came to involve ever-larger segments of society and became more burdensome. Several European states saw the sizes of their armies increase tenfold between 1500 and 1700. Yet land warfare became largely stalemated. The new technologies, and mercenaries, could be bought by any power with money. When a nation threatened to become dominant, alliances would form against it. Defeated nations quickly recovered and were soon ready to fight again.

Warfare evolved into global flanking operations. The development of sea power and acquisition of colonies became part of stalemated European warfare. Yet expanding navies entailed further problems of complexity and cost. In 1511, for example, James IV of Scotland commissioned the building of the ship Great Michael. It took almost one-half of a year’s income to build, and 10% of his annual budget for seamen’s wages.

In 1499 Louis XII asked what was needed to ensure a successful campaign in Italy. He was told that three things alone were required: money, money, and still more money. As military affairs grew in size and complexity finance became the main constraint. The cost of putting a soldier in the field increased by 500% in the decades before 1630. Nations spent more and more of their income on war, but it was never enough. The major states had to rely on credit. Even with riches from her New World colonies, Spain’s debts rose 3000% in the century after 1556. War loans grew from 18% interest in the 1520s to 49% in the 1550s.

European competition stimulated great complexity in the form of technological innovation, development of science, political transformation, and global expansion. To subsidize European competition it became necessary to secure the produce of foreign lands, and later fossil and nuclear fuels. New forms of energy, and non-local resources, were channeled into this small part of the world. This concentration of global resources allowed European conflict to reach heights of complexity and costliness that could never have been sustained with European resources alone (Kennedy, 1987; Parker, 1988; Creveld, 1989; Rasler and Thompson, 1989; Tainter, 1992; Sundberg et al., 1994).

5. DiscussionThese cases illustrate divergent outcomes to long-term problem solving, and different scenarios for the success or failure of any problem solving system. The scenarios are collapse; resiliency and recovery through simplification; and sustainable problem solving based on increasing complexity subsidized by new resources. These scenarios provide models for the development of problem-solving institutions (Tainter, 2000b, pp. 33–37; Allen et al., 2003, pp. 389–391).

In the Roman Model, problem solving drives increasing complexity and costs that cannot be subsidized by new sources of energy. In time there are diminishing returns to problem solving. Problem solving continues by extracting higher levels of resources. Fiscal weakness and disaffection in time compromise problem solving and initiate collapse. In the Byzantine Model, the institution, perhaps no longer having resources to increase complexity, systematically simplifies. The Byzantine example was a resilient response because it involved abandoning long-established traditions of government and society. In such a case, costs are reduced and the productive system is enhanced. It is a strategy that in the Byzantine case allowed for fiscal recovery and eventual expansion. This is also the strategy employed by many businesses over the past 25 years, in which simplification of management and elimination of costs contributed to competitiveness and recovery.

Finally, there is the European Model, in which we still participate. Problem solving produces ever-increasing complexity and consumption of resources, regardless of long-term cost. The Europeans succeeded in part through competition induced ingenuity, but also through luck. Over the horizon they found new resources that could be turned to European advantage. Today we fund complexity and problem solving through fossil and nuclear fuels. We have sustained this strategy to date, but it is important not to downplay the role of luck. Sustainability from the Renaissance through today involved a combination of innovation and finding new energy sources. In the historical sequence leading to today’s world, the lucky part was that there were new resources to be discovered. Had European luck proved otherwise, the world today would be a very different place.

The framework linking social complexity to sustainability, and these case studies, convey several lessons about sustainability in a human system. These are:

1. Sustainability is an active condition of problem solving, not a passive consequence of consuming less.

2. Complexity is a primary problem-solving tool, including problems of sustainability.

3. Complexity in problem solving is an economic function, and can reach diminishing returns and become ineffective.

4. Complexity in problem solving does its damage subtly, unpredictably, and cumulatively over the long term. Sustainability must therefore be a historical science.

5. Sustainability may require greater consumption of resources rather than less. One must be able to afford sustainability.

6. The members of an institution may resort to resiliency as a strategy of continuity only when the option of sustainability is foreclosed.

7. A society or other institution can be destroyed by the cost of sustaining itself.

6. Coping with complexityThe study of social complexity does not yield optimistic results. If social complexity is potentially so detrimental to sustainability in the long-term, it is worthwhile to develop strategies to halt or mitigate the process. I offer some thoughts on the matter, emphasizing that what follows is general and initiatory.

It is important to emphasize that complexity is not inherently detrimental. If it were, we would not resort to it so readily. Complexity is always a benefit-cost function. We increase complexity to solve problems because most of the time it works, and the costs either seem affordable, are not evident, or can be shifted onto others or the future. It is the cumulative cost of complexity that causes damage.

Seven strategies for coping with complexity can be discerned. These are not sequential steps, nor are they mutually exclusive. They are simply ideas that can work alone or in combination. Some of these strategies would clearly have only short-term effects, while others may be effective for longer. The first strategy, however, is essential in all long-term efforts toward sustainability.

1. Be aware: Complexity is most insidious when the participants in an institution are unaware of what causes it. Managers of problem-solving institutions gain an advantage by understanding how complexity develops, and its long-term consequences. Developing such an understanding has been the main purpose of this essay and related work (Tainter, 1988, 1995, 2000a, 2000b; Allen et al., 2003). It is important to understand that unsustainable complexity may emerge over periods of time stretching from years to millennia, and that cumulative costs bring the greatest problems.

2. Don’t solve the problem: This option is deceptively simple. As obvious as it seems, not solving problems is a strategy that is rarely adopted. The worldview of Western industrial societies is that ingenuity and incentives can solve all problems. Ignorance of complexity, combined with the fact that the cost of solving problems is often deferred or spread thinly, reinforces our problem-solving inclination. Yet often we do choose not to solve problems, either because of their cost or because of competing priorities. Appropriators and managers often choose not to solve problems. When the U.S. Congress, for example, terminated funding for the Superconducting Super Collider in 2003, it was because of the escalating costs of problem solving in the project.

3. Accept and pay the cost of complexity: This is a common strategy, perhaps the most common in coping with complexity. It too is deceptively simple. Governments often pay the cost of problem solving by increasing taxes. Businesses may do the same by increasing prices. The problem comes when taxpayers and consumers rebel, or when a firm’s competitors offer a similar product at a lower cost. Paying the true, ongoing cost of complexity can generate high levels of conflict, as in current debates over internalizing the environmental costs of economic activity.

4. Find subsidies to pay costs: This was the strategy employed by Europeans when they paid the cost of their own complexity first by appropriating the surpluses of foreign lands, then by deploying fossil and nuclear fuels. Modern industrial economies of course run by such subsidies, and without them could not be nearly so complex. This process came about through past problem solving (Wilkinson, 1973). As seen in the European case study, the right subsidies can sustain complex problem solving for centuries. Anxiety over future energy is not just about maintaining a standard of living. It also concerns our future problem-solving abilities.

5. Shift or defer costs: This is one of the most common ways to pay for complexity. Budget deficits, currency devaluation, and externalizing costs exemplify this principle in practice. This was the strategy of the Roman Empire in debasing its currency, which shifted to the future the costs of containing current crises. Governments before the Roman Empire also practiced this subterfuge, as have many since. As seen in the case of the Romans, it is a strategy that can work only for a time. When it is no longer feasible, the economic repercussions may be far worse than if costs had never been deferred. In another example, the contemporary software industry externalizes the cost of complexity in its products by shifting the cost of support onto users and information technology staffs. The debate over valuing ecosystem services and full-cost accounting concerns precisely the matter of whether contemporary economics should include externalized costs in its theory.

In a hierarchical institution, the benefits of complexity often accrue at the top, while the costs are paid primarily by those at the bottom. These costs are usually invisible to decision-makers. In such a common situation, the costs and benefits of complexity are unconnected. Where this is so, the cost of complexity cannot restrain its growth until the institution becomes dysfunctional.

6. Connect costs and benefits: If one adopts the explicit goal of controlling complexity, costs and benefits must be connected so explicitly that the tendency for complexity to grow can be constrained by its costs. In an institution this means that information about the cost of complexity must flow accurately and effectively. Yet in a hierarchical institution, the flow of information from the bottom to the top is frequently inaccurate and ineffective (McIntosh et al., 2000, pp. 29–30). Thus, the managers of an institution tend to be poorly informed about the cost of complexity. In human institutions, a primary requirement of connecting costs and benefits is to have effective channels of vertical communication.

There is much concern among critics of neoclassical economic theory that the theory glosses over many costs (Georgescu-Roegen, 1971; Daly, 1977), dismissing these as ‘‘externalities.’’ Attempts to broaden economic theory by incorporating environmental costs and subsidies are also an attempt to connect the costs and benefits of complexity.

7. Recalibrate or revolutionize the activity: This involves a fundamental change in how costs and benefits are connected, and is potentially the most far-reaching technique for coping with complexity. The strategy may involve new types of complexity that lower costs, combined with positive feedback among new elements that amplifies benefits and produces growth. True revolutions of this sort are rare, so much so that sometimes we recognize them in retrospect with a term signifying a new era: the Agricultural Revolution, the Industrial Revolution, the Information Revolution, and the like. A hopeful note is that often these revolutions seem to occur just when they are needed. Fundamental changes of this sort depend on opportunities for positive feedback, where elements reinforce each other. For example, Watt’s steam engine facilitated the mining of coal by improving pumping water from mines. Cheaper coal meant more steam engines could be built and put to use, facilitating even cheaper coal (Wilkinson, 1973). Put a steam engine on rails and both coal and other products can be distributed better to consumers. Combine coal, steam engines, and railroads, and we had most of the components of the Industrial Revolution, all mutually reinforcing each other. The economic system became more complex, but the complexity involved new elements, connections, and subsidies that produced increasing returns.

The transformation of the U.S. military since the 1970s provides a more recent example. So profound is this transformation that it is recognized by its own acronym: RMA, the revolution in military affairs. The revolution involves extensive reliance on information technology, as well as the integration of hardware, software, and personnel. Weapons platforms are just part of this revolution, since weapons now depend on integration with sensors, satellites, software code, and command systems (Paarlberg, 2004). This is a military that is vastly more complex than ever before. That complexity is of course costly, but the benefits include both greater effectiveness and significant cost savings. Being able to pinpoint targets means less waste of ordinance, less need for large numbers of weapons platforms, and lower quantitative requirements for personnel.

An initial reaction to these strategies might be that some seem to enhance sustainability in the long run (e.g., 1, 4, 6, 7), while others may enhance sustainability in the short-run but degrade it over time (2, 3, 5). In fact, all solutions to the problem of complexity are temporary. Since industrial societies inexorably generate more and more complexity, there is no optimum level of complexity, no plateau to be maintained by complexity vigilance. The evolution of complexity, and its consequences for sustainability, presents a continuously varying spectrum of opportunities and costs. To use an athletic metaphor, there is no point where the game is won, or even ends. Given the role of complexity in both sustainability and collapse, ‘‘success’’ consists substantially of staying in the game.

7. ConclusionIn ecology, differentiation and diversity emerge from available energy and water, and from competition, while greater diversity is often argued to produce stability or sustainability. On occasion human systems also differentiate in response to major influxes of energy. Major complexifications stimulated by the sudden availability of energy are rare in human history, and usually such great transitions are themselves initiated by the search for solutions to problems (e.g., Wilkinson, 1973;

Cohen, 1977). More commonly, social complexity grows incrementally through the mundane process of day-to-day adjustments to ordinary problems. Complexity that increases in this manner may do so prior to the development of additional energy to fund the increased complexity. We see this clearly in the Roman and European cases, in which urgent problems were addressed by rapid increases in complexity. The complexity was paid for subsequently by increasing peasant taxation or by finding and deploying new energy subsidies. In these cases, which illustrate a common process, complexity emerges from efforts to be sustainable, and energy production follows increases in complexity.

Problem-solving systems follow trajectories that take decades, generations, or centuries to complete. Problem solving can produce stable, increasing, or diminishing returns, or it can produce all three at different points in time. Complexity that emerges through problem solving is vital for sustainability, yet may also undermine it. The difference between these outcomes emerges in part from where the problem-solving system lies on an evolving benefit/cost trajectory.

A primary characteristic of a sustainable society is that it will have sustainable institutions of problem solving. Until this point in human history, sustainable institutions have been those that give stable or increasing returns, or diminishing returns that can be subsidized by energy supplies of assured quality, quantity, and cost. Today’s institutions have a new challenge and a new opportunity. It is to recognize the subtle, long-term problem of complexity and develop ways to mitigate or control it.

AcknowledgmentsAn earlier version of this paper was presented in the session ‘‘Ecological Complexity and Sustainability’’ at the 88th Annual Meeting of the Ecological Society of America, Savannah, Georgia. I am grateful to Edward Rykiel for the invitation to participate in the session, and to an anonymous reviewer for comments.

References (see .pdf version)